Client Alerts

SEC Adopts Rules Enhancing Climate-Related Disclosures

March 2024

Client Alerts

SEC Adopts Rules Enhancing Climate-Related Disclosures

March 2024

Almost two years after proposing rules on climate-related disclosures on March 6, 2024, the Securities and Exchange Commission (“SEC”) adopted rules mandating specific climate-related disclosures by reporting companies in registration statements and annual reports on Form 10-K (“Final Rules”). The rules, which passed by a 3-2 party line vote, mandate that public companies enhance climate-related disclosures in their annual reports and registration statements, including risks that have materially impacted or are reasonably likely to have a material impact on their business strategy, results of operations, or financial condition.

The Final Rules will continue to be controversial despite the SEC’s elimination of the Scope 3 greenhouse gas (“GHG”) emissions (indirect downstream/supply chain and upstream emissions) disclosure and requiring only Large Accelerated Filers and Accelerate Filers, subject to a materiality threshold, to report on Scope 1 GHG emissions (the company’s direct GHG emissions) and Scope 2 GHG emissions (the company’s indirect GHG emissions from purchased electricity and other forms of energy). Several lawsuits already seek to challenge the climate-related disclosure rules. For a critique of the Final Rules, see Commissioner Hester M. Peirce’s statement “Green Regs and Spam.”

Indeed, the Final Rules were subject to a stay issued on March 15, 2024 by the Fifth Circuit Court of Appeals. The petitioners claimed that they would be “irreparably harmed” by the failure to grant a stay. The SEC opposed the petitioners’ motion. The petitioners asserted that the Final Rules violate the First Amendment and the Supreme Court’s Major-Questions Doctrine and is arbitrary and capricious and not supported by substantial evidence. On the other side, environmental groups, including the Sierra Club, filed a petition in the District of Columbia Circuit Court of Appeals against the SEC arguing that the Final Rules do not go far enough. We expect more litigation, and, at some point, a court (and perhaps the Supreme Court) will determine the fate of the Final Rules. In the meantime, on March 21, 2024, the Eighth Circuit Court of Appeals was chosen randomly via a lottery to hear the consolidated legal challenges to the Final Rules. Following the lottery selecting the Eighth Circuit, the Fifth Circuit transferred the petition and dissolved the stay. The Eighth Circuit is not obligated to reinstate the stay but could do so as the litigation proceedings begin to ramp up.

Update: On April 4, 2024, the SEC ordered that the Final Rules are stayed pending the completion of judicial review of the consolidated Eighth Circuit petitions. Read the order issuing stay at the SEC’s website.

In the Final Rules adopting release, the SEC emphasizes that investors and their representatives seek information to evaluate the climate-related risks on a company’s business, financial standing, and – consequently – its securities’ valuation. One of the primary objectives of adopting the mandated climate-related disclosures is to facilitate the disclosure of information to investors and their representatives regarding buying, holding, selling, or voting securities. Furthermore, in the Final Rules adopting release, the SEC acknowledges that while some companies already disclose climate-related risks, the inconsistency of such disclosures poses challenges for investors seeking comparative analysis.

The Final Rules include a new subpart 1500 of Regulation S-K and Article 14 of Regulation S-X. The SEC recommends that registrants provide the required disclosures outlined in subpart 1500 of Regulation S-K under a separate section of the Form 10-K titled “Climate-Related Disclosure.” Smaller reporting companies, emerging growth companies, and nonaccelerated filers are exempt from the GHG emissions disclosure requirements. Filers subject to the Final Rules must disclose information about the following:

- Climate-related risks that have materially impacted or are reasonably likely to have a material impact on the registrant’s business strategy, operational results, or financial condition;

- Actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook;

- Description, both quantitative and qualitative, of material expenditures and impacts resulting from mitigation or adaptation activities for material-related risks as undertaken as part of the registrant’s strategy;

- Specified disclosures regarding a registrant’s activities to mitigate or adapt to a material climate-related risk, including the use of transition plans, scenario analysis, or internal carbon prices;

- Any oversight by the Board of Directors of climate-related risks and management’s role in assessing and managing climate-related risks;

- Processes for identifying, assessing, and managing material climate-related risks and integration into the registrant’s overall risk management system or processes;

- Information about climate-related targets or goals that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition; disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal;

- For Accelerated Filers and Large Accelerated Filers, disclosure of material Scope 1 emissions and/or Scope 2 emissions;

- Assurance reports at the limited assurance level for Large Accelerated Filers after an additional transition period;

- Capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions – such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise – subject to applicable one-percent and de minimis disclosure thresholds, disclosed in a note to the financial statements;

- Capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements; and

- If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements.

The Final Rules mandate both domestic and foreign private issuer registrants to:

- File the climate-related disclosure in its registration statements and Exchange Act Form 10-Ks filed with the SEC;

- Provide the Regulation S-K mandated climate-related disclosures either in a separate, appropriately captioned section of its registration statement or Form 10-K or in another appropriate section of the filing, such as Risk Factors, Description of Business, or Management’s Discussion and Analysis, or, alternatively, by incorporating such disclosure by reference from another SEC filing as long as the disclosure meets the electronic tagging requirements of the Final Rules; and

- Electronically tag both narrative and quantitative climate-related disclosures in Inline XBRL.

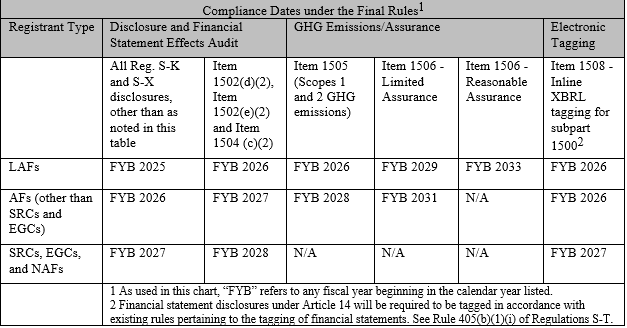

The Final Rules will become effective 60 days after publication in the Federal Register. Compliance with the Final Rules will come in phases as follows:

The SEC provided the following example: a Large Accelerated Filer with a January 1 fiscal-year start and a December 31 fiscal year-end date will not be required to comply with the climate disclosure rules (other than those pertaining to GHG emissions and those related to Item 1502(d)(2), Item 1502(e)(2), and Item 1504(c)(2), if applicable) until its Form 10-K for fiscal year ended December 31, 2025, due in March 2026.

As part of the Final Rules, a safe harbor in Item 1507 of Regulation S-K was added. Item 1507 provides a safe harbor from private liability for climate-related disclosures (excluding historical facts) pertaining to transition plans, scenario analysis, the use of an internal carbon price, and targets and goals. The safe harbors will apply to forward-looking statements in connection with certain transactions and disclosures by certain issuers. In addition to the forward-looking statement exemptions, the SEC has authority to provide exemptions from liability for other statements based on projections or other forward-looking information if the SEC determines that such exemption is consistent with the public interest and the protection of investors.

Companies subject to the Final Rules should assess how to bring their reporting practices into alignment with them. Although climate risk disclosures currently may be disclosed on a company’s website, they will be disclosed as part of a company’s requisite SEC filings (10-Ks and registration statements). The Final Rules will require requisite companies to evaluate climate-related risk with a materiality standard. They also must retain evidence supporting materiality determinations, even if potential disclosures are deemed immaterial.

ADDITIONAL INFORMATION

For more information, please contact:

- Kristen A. Baracy | 213.430.3603 | kristen.baracy@tuckerellis.com

- Robert M. Loesch | 216.696.5916 | robert.loesch@tuckerellis.com

This Client Alert has been prepared by Tucker Ellis LLP for the use of our clients. Although prepared by professionals, it should not be used as a substitute for legal counseling in specific situations. Readers should not act upon the information contained herein without professional guidance.