Client Alerts

SEC Adopts Final Dodd-Frank Pay Versus Performance Disclosure Rules

October 2022

Client Alerts

SEC Adopts Final Dodd-Frank Pay Versus Performance Disclosure Rules

October 2022

By: Robert Loesch and Glenn Morrical

The SEC has adopted final rules – based on proposed rules first made in 2015 – which require reporting companies to disclose the relationship between compensation paid to the company’s named executive officers (NEOs) and the company’s financial performance, known as “pay versus performance disclosures.” The new rules were adopted under the requirements of Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The SEC’s adopting release can be found here.

Reporting companies are required to comply with the new disclosure requirements in proxy/information statements that include executive compensation disclosure for fiscal years ending on or after December 16, 2022. Thus, calendar-year companies will be required to provide the pay versus performance disclosures in their 2023 proxy statements.

Companies should begin soon to gather data and perform the analysis that they will need to include in the new pay versus performance disclosures.

Disclosure Requirements

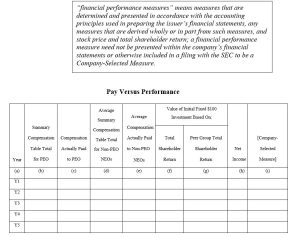

The new rules require reporting companies to disclose in their proxy/information statements (where executive compensation disclosure is required) a new compensation table that includes the information listed below for the previous five years:

- For the principal executive officer (PEO) and, as an average, for the other NEOs, (i) the Summary Compensation Table measure of total compensation, and (ii) a measure reflecting “compensation actually paid,” calculated as prescribed by the rule;

- The company’s total shareholder return (TSR) calculated in the same manner as shown in the performance graph already required by the proxy rules;

- The company’s peer group TSR, using the performance graph data or, if applicable, the company’s peer group data used for compensation discussion and analysis disclosure;

- The company’s net income; and

- A financial performance measure selected by the company (the “Company-Selected Measure”) that, in the company’s assessment, represents the most important financial performance measure the company uses to link compensation actually paid to the company’s NEOs to company performance (that is not otherwise required to be disclosed in the table).

- The new pay versus performance disclosure rules also require companies to provide a clear description (graphically, narratively, or a combination of the two) of (i) the relationships between each of the financial performance measures included in the table and the executive compensation actually paid to its PEO and, on average, to its other NEOs over the last five years, and (ii) the relationship between the company’s TSR and its peer group TSR.

- Companies will be required to provide an unranked list of at least three but no more than seven of the most important performance measures used to link executive compensation actually paid to their NEOs during the last year to company performance. Companies must select the Company-Selected Measure for the tabular disclosure from among the financial performance measures included in this list.

- Companies may include non-financial performance measures in the list if they are among the company’s most important performance measures.

- Generally, a company will be required to provide disclosure of five-year information but is permitted to provide instead three-year information in its first proxy/information statement requiring disclosure and adding another year of disclosure in each of the two subsequent filings.

- If more than one person served as the registrant’s PEO during the covered fiscal year, a company must provide information for each person who served as PEO during that period separately in additional columns (b) and (c) for each such person.

- Companies also are required to tag the disclosures in an interactive data format using eXtensible Business Reporting Language.

Covered Companies

The rule applies to all reporting companies except for foreign private issuers, registered investment companies (other than business development companies), and emerging growth companies. Smaller reporting companies would be subject to scaled disclosure requirements.

Our Securities and Capital Markets attorneys will be pleased to discuss with you the potential impact of the final pay versus performance disclosure requirements. Please contact your regular attorney at Tucker Ellis or any of the following attorneys listed below.

ADDITIONAL INFORMATION

For more information, please contact:

- Robert M. Loesch | 216.696.5916 | robert.loesch@tuckerellis.com

- Jayne E. Juvan | 216.696.5677 | jayne.juvan@tuckerellis.com

- Christopher J. Hewitt | 216.696.2691 | christopher.hewitt@tuckerellis.com

- Kristen A. Baracy | 213.430.3603 | kristen.baracy@tuckerellis.com

This Client Alert has been prepared by Tucker Ellis LLP for the use of our clients. Although prepared by professionals, it should not be used as a substitute for legal counseling in specific situations. Readers should not act upon the information contained herein without professional guidance.